Understanding the Importance of Finance Life Skills

Financial life skills are crucial for autistic adults to achieve independence. While some excel in their careers, others need help managing finances.

Life Skills for Special Needs Adults

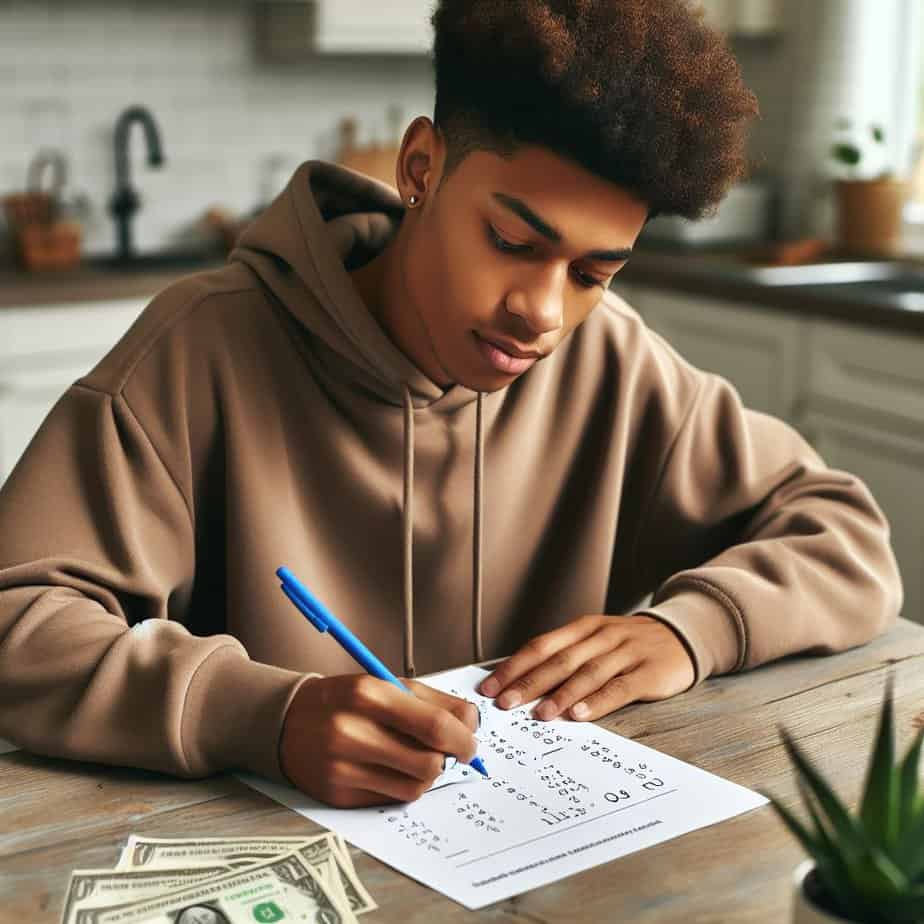

As individuals with autism transition into adulthood, providing them with practical skills to manage their lives independently becomes vital. Being able to handle personal finances well is a key aspect that allows them to live freely and make smart financial choices. Understanding Concepts of Life Skills for Autistic Adults: Individuals with autism sometimes have difficulty grasping abstract money ideas because of focus issues. Using stories, age-appropriate illustrations, and breaking things down into smaller steps make learning more enjoyable and accessible for them.

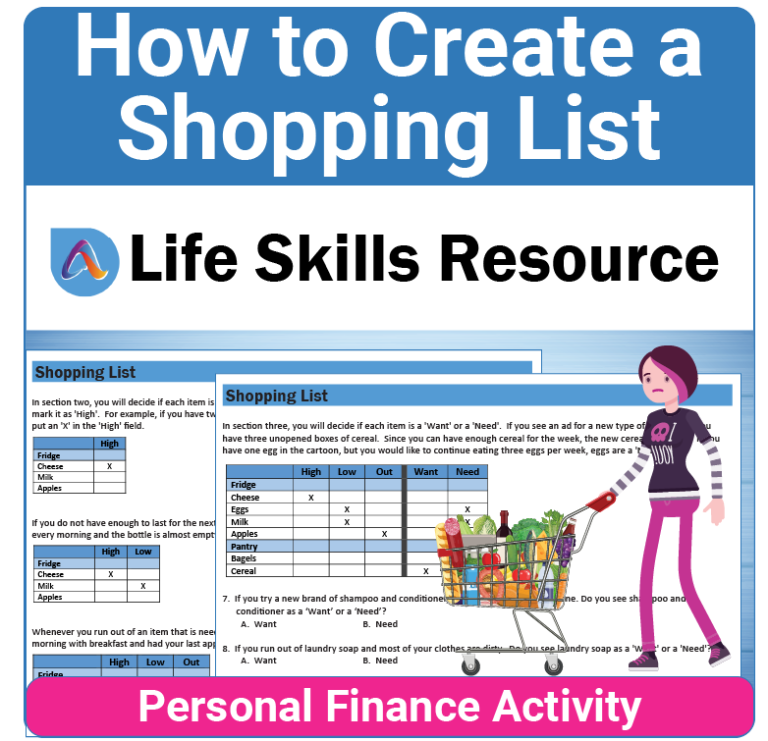

Adulting on the Spectrum creates activities, worksheets, videos, and blog posts specifically for neurodiverse learners. Our finance materials use simple words and real examples to teach vital skills. Some of our standout worksheets include those on credit score education, responsible credit usage, and expense tracking via relatable scenarios. Others cover debit card alerts, comparing payment methods, and understanding credit cards. Several valuable money skills can be learned, including budgeting, banking basics, bill paying, saving, and credit awareness. Learning these skills promotes independence, protects from debt, and secures the future while alleviating caregiver pressure.

Common finance life skills and why they are important

Some critical finance life skills that special needs adults must learn include:

Budgeting: Managing expenses which requires allocating funds to needs and wants while determining income, expenses, and savings goals.

Banking: Skills like using checks, accessing ATMs, mobile banking, and reading financial statements.

Paying Bills: Learning to pay utility, phone, internet, rent/mortgage on time helps build credit history.

Saving Habits: Starting an emergency fund and long-term savings for life goals boosts financial stability.

Credit Awareness: Maintaining good credit allows access to loans at lower rates and demonstrates financial responsibility.

Tax Knowledge: Filing one’s own returns or getting assistance ensures compliance and receiving tax benefits.

Insurance: Understanding types like health, car, and renter’s coverage provides a safety net against uncertainties.

Mastering such skills empowers individuals to make responsible financial choices, avoid debt, build assets, and safeguard their future well-being. It also alleviates caregiver burden with reduced supervision needs.

Finance life skills activities and resources from Adulting on the Spectrum

Adulting on the Spectrum is a leading resource for life skills activities, videos, and blogs to support autistic individuals. Our finance worksheets use simple language and real-life examples to teach crucial life skills like using credit, budgeting, and tracking expenses.

We also answer common questions about our approach. Our materials are designed to effectively develop skills using evidence-based methods. Ongoing support and guidance from families further enhance abilities and promote independent decision-making over time. With patience and understanding, individuals with autism can successfully manage their finances.

Some of our highly useful finance life skill worksheets include:

1. All About Credit: Explains the concepts of credit scores, credit reports, and responsible use of credits in an easy-to-understand manner.

2. Manage Money: Teaches budgeting, tracking expenses, savings, and managing finances through engaging scenarios.

3. How Credit Cards Work: Promotes credit card literacy by covering statements, minimum payments, and interest rates.

4. Methods of Payment: Compares cash, checks, credit cards, debit cards, and more for different financial needs.

5. Debit Card Alerts: Teaches safety with cards through low balance and high purchase alerts.

Making Learning Finance Skills Fun and Rewarding

Incorporating games, role-playing, and rewards can make building finance skills motivating and engaging for autistic learners. Educational board games, online games, and DIY activities teach concepts in a fun way. Providing small rewards for mastering skills and tracking progress on charts taps into special interests. Tying lessons into preferred topics also enhances enjoyment and participation.

Leveraging Technology for Financial Independence

Mobile payment apps, money management apps, and banking websites with user-friendly interfaces can make handling finances increasingly accessible for autistic individuals. Features like transaction notifications, saving automation, voice commands, fingerprint login, and spending summaries simplify managing money digitally. Video tutorials for using financial tech provide guided learning at their own pace.

Mastering key money skills is crucial for autistic adults seeking elevated independence. Resources from Adulting on the Spectrum using evidenced-based methods effectively impart finance life abilities. Ongoing parental guidance and encouragement can help individuals with special needs develop life skills and practice independent decision-making, including managing their finances.